Motor Policy Cancellation

Motor Policy Cancellation Guidelines

You can request to cancel your motor policy by the provision of chapter 6 in the Motor Policy wording. You can call us in 8007254 or write an email to [email protected].

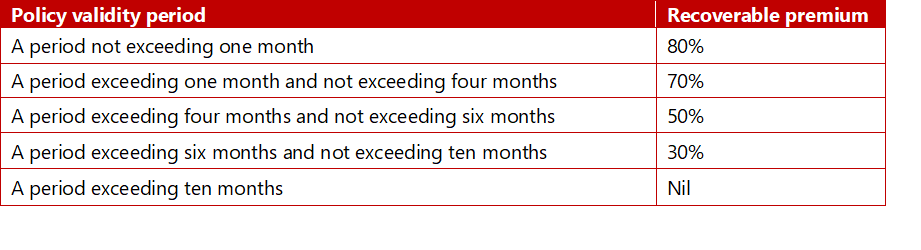

Premium refund shall be processed based on the below given short rate schedule (Schedule no. 4, IA Unified Policy wording), subject to the provisions of chapter 6 in the motor policy wording.

Short Rate Schedule – (Percentage of Recoverable Premium)

You are requested to submit the below mentioned documents are requested for cancellation.

In case of transfer of vehicle ownership

- Ownership transfer certificate or;

- New registration card copy registered under the new owner’s name.

Chapter Six: Policy Termination – Third Party Liability

- Neither the Company nor the Insured may terminate this Policy during its term as long as the Motor Vehicle license is valid.

- However, the Policy may be terminated before its expiration on the grounds of:

- Cancellation of the Motor Vehicle license;

- Submission of a new policy due to change of the Motor Vehicle details; or

- Transfer of the Motor Vehicle title by virtue of a certificate issued by the concerned authority.

- In this case, the Company must refund to the Insured the paid premium after deducting a portion in proportion to the period during which the Policy has remained in effect according to the Short Rate Schedule No. (3) set out in this Policy, provided that there are no paid claims or outstanding claims where the Insured has caused the accident.

- This Policy shall be considered terminated in case of a total loss to the Motor Vehicle, provided that its registration is deleted with a report issued by the Road and Traffic Department confirming that it is unroadworthy, and the Company and the Insured shall remain bound by its provisions before termination

Chapter Six: Policy Termination – Loss and Damage

- The Company may terminate this Policy on the condition that there are serious grounds for termination during the Policy Period by a notice in writing to be sent to the Insured via e-mail, facsimile, hand delivery or registered letter thirty days prior to the fixed date of termination to the latest address of the Insured known by the Company. The Insurance Authority shall be advised of the grounds of such termination. In this case, the Company shall refund to the Insured the paid premium after deducting a portion in proportion to the period during which the Policy has remained in effect.

- The Insured may terminate this Policy by a notice in writing to be sent to the Company via e-mail, facsimile, hand delivery or registered letter seven days prior to the fixed date of

termination. In this case, the Company shall refund to the Insured the paid premium after

deducting a portion in proportion to the period during which the Policy has remained in effect subject to the Short Rate Schedule No. (4), provided that there is no compensation paid to the Insured or pending claims in relation to this Policy during the period of time the

Policy is valid, if the Insured has caused the accident or in cases that are deemed committed by unknown persons. - This Policy shall be considered terminated in case of a total loss to the Motor Vehicle, provided that its registration is deleted with a report issued by the Road and Traffic Department confirming that it is unroadworthy, and the Company shall compensate the Insured according to the provisions of this Policy.