Fleet Insurance

Keeping your business moving

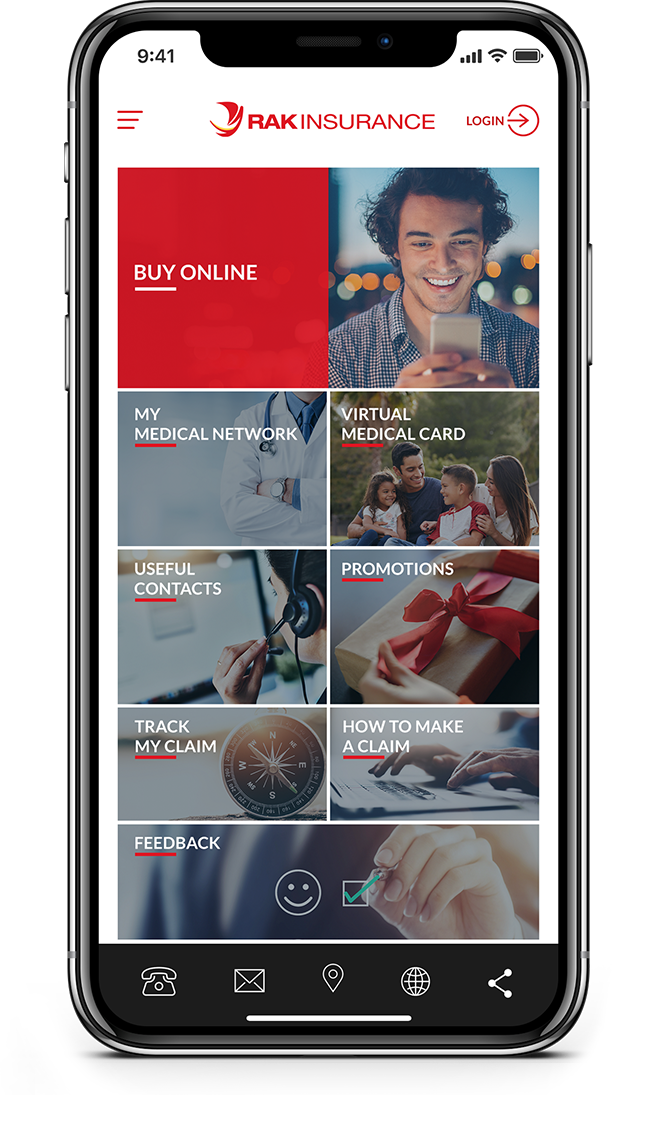

Efficient, Economical, Easy

multiple drivers + multiple vehicles = one simple solution

Managing your Motor needs

Whatever the size or vehicle mix of your Fleet, we can arrange cover to suit your needs. From minimum legal requirement cover such as Third Party Liability to covering employees using their own vehicles in connection with the business, our Fleet Policy keeps pace as your business evolves.

A Motor Fleet policy typically covers the following:

3 vehicles or more

Third Party injury or death and damage caused to their property

Tools belonging to the Insured and/or stock and goods whilst in transit in the vehicle.

Fleet Insurance can also be further tailored to include:

Public or private hire usage (for private drivers/limo transfers or taxis)

Haulage insurance for longer distance transportation of goods

Courier services (localised multi-drop Hire and Reward).

Since there are so many cover variations, it is important to understand your business needs fully: taking into account fleet size, types of vehicles, business activity and frequency of use: as well as who will be driving which vehicles. You should therefore entrust your Fleet to insurance industry professionals so that you are correctly insured and paying a premium that truly reflects your risk.

Fleet Insurance to suit you ... & your budget

Downloads